5 Steps to Get Your Texas Real Estate License

5 Steps to Get Your Texas Real Estate License This Year Do you dream of creating the joy of new homeownership or the satisfaction of guiding sellers through their next chapter? Then, you should consider getting your Texas real estate license! You'll have the opportunity to advocate for clients, le

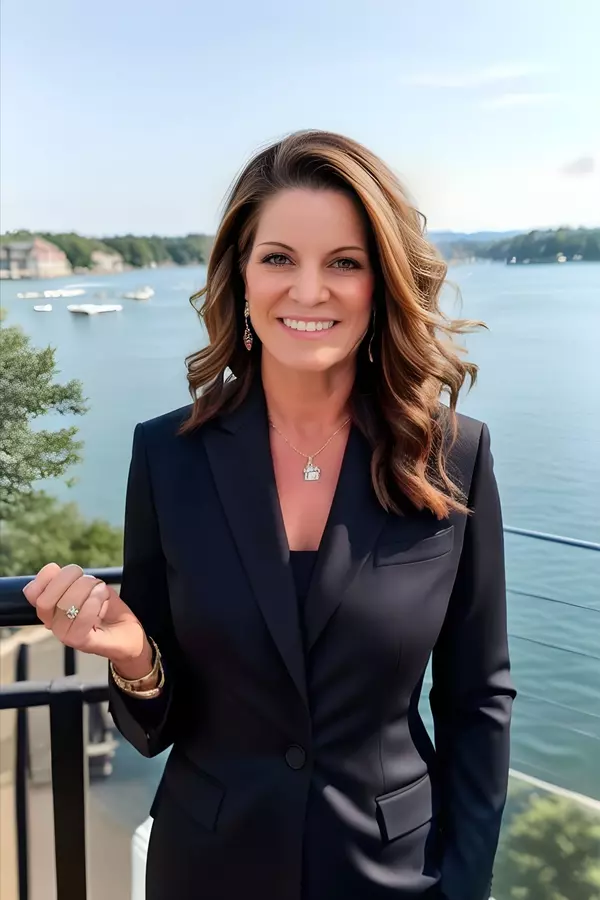

Best Realtor in San Antonio

<section> <h2><strong>Natalie B</strong> - San Antonio’s trusted Realtor for probate, inherited, and family homes, and for buying your next one.</h2> <p>Faith-filled, family-focused, and funny enough to make real estate feel human again.</p> <p>Natalie helps San Antonio and Hill Country homeowner

New Build and Inspections

New Build and Inspections When it comes to purchasing a new home, there is often a common misconception among buyers that a newly constructed property is exempt from inspections. However, this assumption couldn't be further from the truth. Regardless of whether a home is brand new or decades old, co

Categories

- All Blogs (58)

- Basore Real Estate (9)

- Clean Your House (1)

- Community Property Texas (1)

- Divorce Attorney (1)

- Divorce in Texas (1)

- Divorce Realtor (1)

- Divorce Selling Home (1)

- First Time Home Buyer (3)

- Hill Country Homes for Sale (6)

- Home Maintenance (1)

- Homes for Sale in Texas (6)

- HTML (6)

- Move to Austin (6)

- Move to Boerne (6)

- Move to Comfort (6)

- Move to Corpus Christi (5)

- Move to Dallas (5)

- Move to Helotes (5)

- Move to Kerrville (4)

- Move to Lubbock (4)

- Move to San Antonio (6)

- Move to Texas (6)

- Move to TX Hill Country (5)

- movetotexashillcountry (5)

- Preferred Repair Person (3)

- Probate (4)

- Probate Attorney (3)

- Probate Guide (3)

- Probate Real Estate (3)

- Probate Realtor (3)

- Probate Texas (3)

- Real Estate (7)

- Realtor in San Antonio (7)

- Realtor in Texas (7)

- San Antonio Real Estate (7)

- San Antonio Texas Homes for Sale (7)

- staging your home (2)

- Texas Realtor (8)

- Things to Do in the Area (1)

Recent Posts